tax is theft australia

AUD 37001 - AUD 90000. Claiming taxes are not theft because they provide essential services would follow logically that its ok for me to rob you at gunpoint as long as I give you a hand-job after.

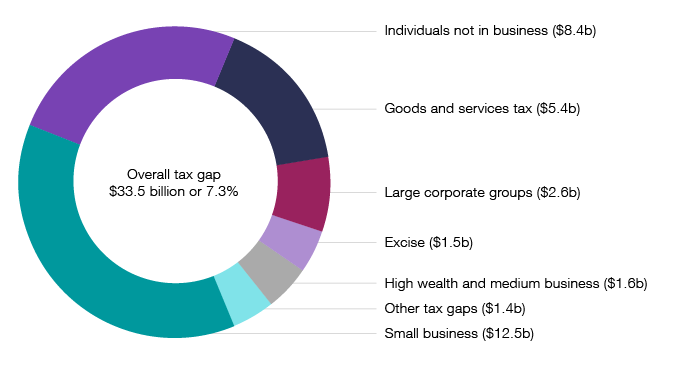

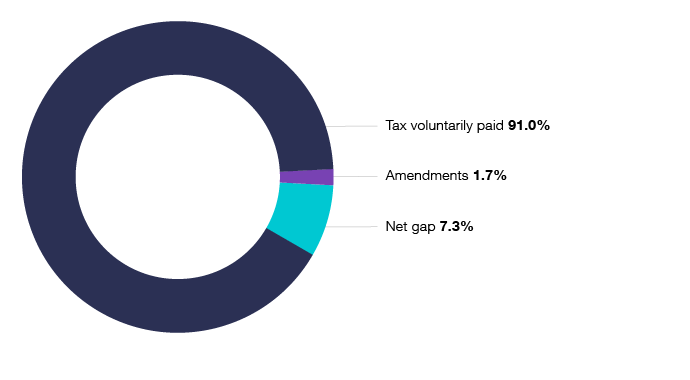

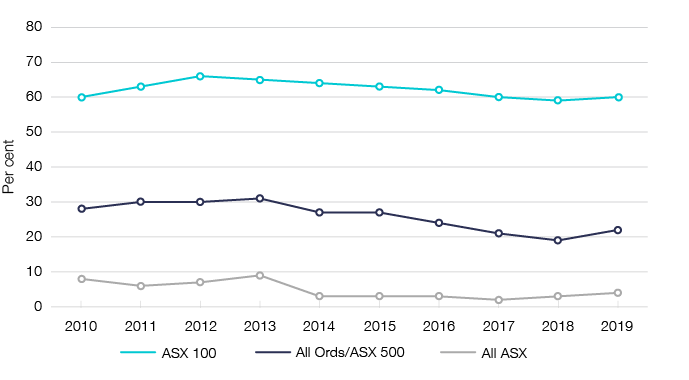

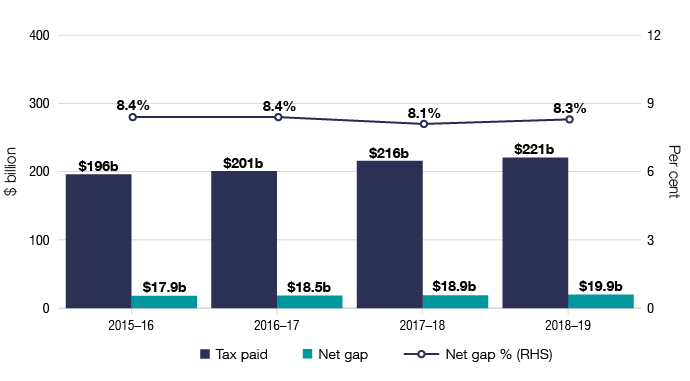

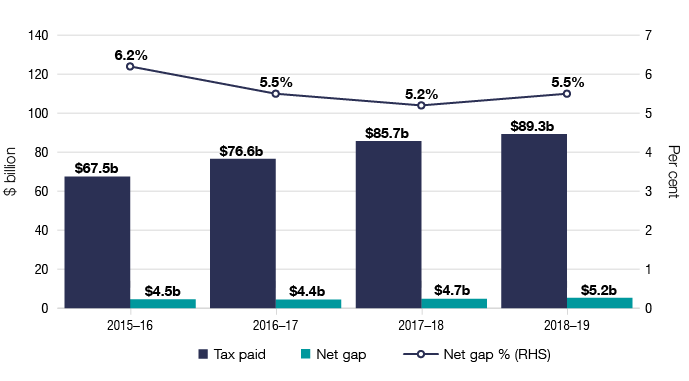

Tax Gap Program Summary Findings Australian Taxation Office

In 2021 around 222 percent of participants who took part in a survey about home burglary in South Australia said they had packages or parcels stolen from.

. Its good news for Australian investors as the ATO are a lot more sympathetic than the IRS. Apr 2 2022. Tax Status and Worldwide Income.

Those incurred in a trade or business those incurred in a transaction entered into for profit or losses arising from other causes such as theft. AUD 180001 and up. Each citizen and resident of Australia is assigned a Tax File Number TFN to be used for tax purposes.

There is also a surcharge for people who dont have acceptable health insurance. TAX IS THEFT PTY LTD Entity 655158740 is a business entity registered with Australian Securities and Investments Commission ASIC. Similarly theft losses used to be tax deductible.

Tax Treaty Article 4 6 Income From Real Property Article 6 7 Dividend Income Article 10 8 Interest Income Article 11. The business registration date is November 9 2021. Reporting lost or stolen crypto in Australia.

May 6 2022 United States Attorney Jennifer Arbittier Williams announced that Guy Menard Charles of Naples FL was convicted after trial of 23 counts of fraud and identity theft for filing false federal income tax returns as part of a scheme to fraudulently reduce taxes and inflate the tax refund amounts claimed on tax returns he prepared for his clients. हनद मरठ বল தமழ മലയള ગજરત తలగ ಕನನಡ ਪਜਬ. 51667 plus 45 cents for each 1 over 180000.

Fuck your essential services. 5 Residence Under the Australian-US. 5092 plus 325 cents for each 1 over 45000.

At the end of the financial year your income statement or payment summary will show your total income from your employer and how much tax they have taken. On 4 October 2019 Ryan McCarthy 27 was sentenced in the Brisbane District Court to 5 years imprisonment with a non-parole period of 18 months for placing false job advertisements online and stealing the identities of job applicants in order to lodge false income tax returns. He was also ordered to pay reparations of more than 167000.

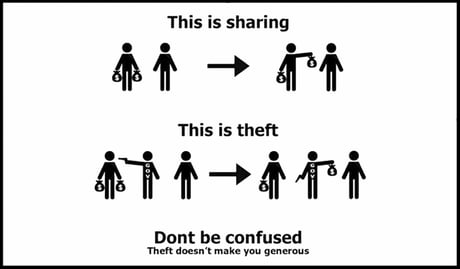

The ATO has clear guidance on reporting lost or stolen crypto on your tax report. 19 cents for each 1 over 18200. The position that taxation is theft and therefore immoral is found in a number of political philosophies considered radical.

The complete texts of the following tax treaty documents are available in Adobe PDF format. AUD 90001 - AUD 180000. 165 allows taxpayers to deduct three types of losses.

Australia has enthusiastically backed calls to close corporate tax loopholes in its role as host of this weekends G20 summit in Brisbane making it a primary focus of the meeting. This position is often held by anarcho-capitalists objectivists most minarchists right-wing libertarians and voluntaryists. This is all relative and for the purpose of the example because I know the real rates are nowhere near these but there has to be a.

AUD 54097 AUD 045 per dollar above AUD 180000. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. 4 Saving Clause in the Australia Income Tax Treaty.

Get in touch with us now. There is additionally a Medicare tax of 2. Property Tax is Property Theft.

AUD 20797 AUD 037 per dollar above AUD 87000. Section 25-45 of the Act allows a deduction for a loss by theft stealing embezzlement larceny defalcation or misappropriation by an employee or agent other than one employed solely for private purposes of any amount returned or returnable by the taxpayer as assessable income. The amount of tax you pay depends on.

This number should be safeguarded as it can be used for identity theft similar to US. Theft is defined broadly and encompasses various criminal conducts including larceny embezzlement and robbery. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2.

29467 plus 37 cents for each 1 over 120000. 1 US Australia Tax Treaty 2 What Types of Tax Law Is Included in the Treaty. The Australian equivalent of the IRS is the ATO Australian Tax Office and they collect the taxes within the country.

However theft losses were also affected in the tax reform. The taxpayer was unable to prove that a theft had actually occurred or that if one had occurred he had sustained the loss in 2015 as required by Sec. Your income statement is available in ATO online services via myGov.

A 2 percent fee is charged by the government of AustraliaThats a tax of 26 cents on a litre of alcohol 17 times greater than what Germans pay only 13 centsAustralians pay an average of 3 in taxes on beer according to the Brewers Association of AustraliaThere is an annual budget of 6 billion. It should be noted that these changes are not permanent TCJA will only be in effect until the end of 2025. It marks a significant departure from conservatism and classical liberalism.

2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020. Like a sliding scale for property tax based on how many acres an individual owns. For example own 1 acre you pay 0 property tax.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. The principal address is Australia. How Much Is The Beer Tax In Australia.

Property Tax is immoral inequitable hidden causes rents to rise increases homelessness and has no place in a fair and equitable society. Proponents of this position see taxation as a violation of. 2021-46 an individual taxpayer was denied a theft loss deduction of 300000 that was claimed on his 2015 tax return.

How much income you earn. The government is driven by war. As of January 1 2018 no longer can a taxpayer deduct theft on his taxes unless it was due to a federally declared disaster.

The free market is driven by productivity. The above rates do not include the Medicare levy of 2. In most cases your employer will deduct the income tax from your wages and pay it to the ATO.

In a recent case Baum TC. Australia - Tax Treaty Documents. Unless further changes are made before that time the law will again allow for tax write-offs from theft starting January 1 2026.

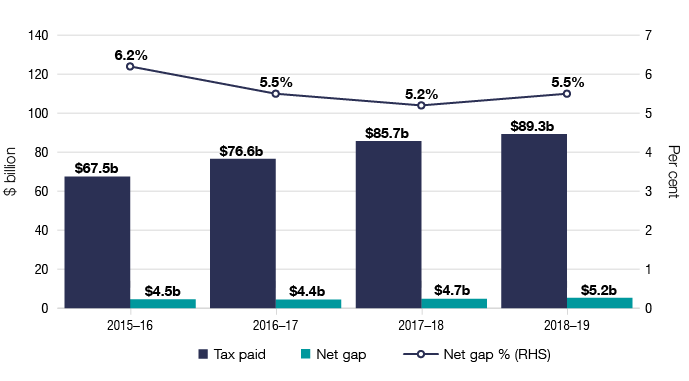

The Performance Of The Tax System Australian Taxation Office

Is Taxation By Definition A Form Of Theft Why Or Why Not Quora

2016 17 Tax Stats Released Australian Taxation Office

Crypto Tax In Australia The Definitive 2021 2022 Guide

Why Some Corporations Pay No Tax Australian Taxation Office

If Like Libertarians Say Taxation Is Theft Then Capitalist Extraction Of Surplus Value Is Grand Larceny But I Never Hear Those Bootlicking Motherfuckers Talk About That R Socialism

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Joint Chiefs Of Global Tax Enforcement Australian Taxation Office

Tax Gap Program Summary Findings Australian Taxation Office

Tax Gap Program Summary Findings Australian Taxation Office

Pdf Tax Related Behaviours Beliefs Attitudes And Values And Taxpayer Compliance In Australia

I Lost Money In A Crypto Scam Will I Be Taxed Koinly

Stealing Offences In The Australian Capital Territory Act

Is Taxation By Definition A Form Of Theft Why Or Why Not Quora

How A Tax Evasion Whistleblower Became One Of Europe S Most Wanted Time

We All Know That Taxes Are Theft 9gag

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

What You Need To Know About Tax Scams Noticias Sobre Seguranca